In the days leading up to Christmas, businesses statewide opened an unwelcome present from state government. A major tax increase. The Washington State Employment Security Department (ESD) has sent out their end of the year tax rate notices to all businesses statewide, notifying them of their unemployment tax rates for 2021.

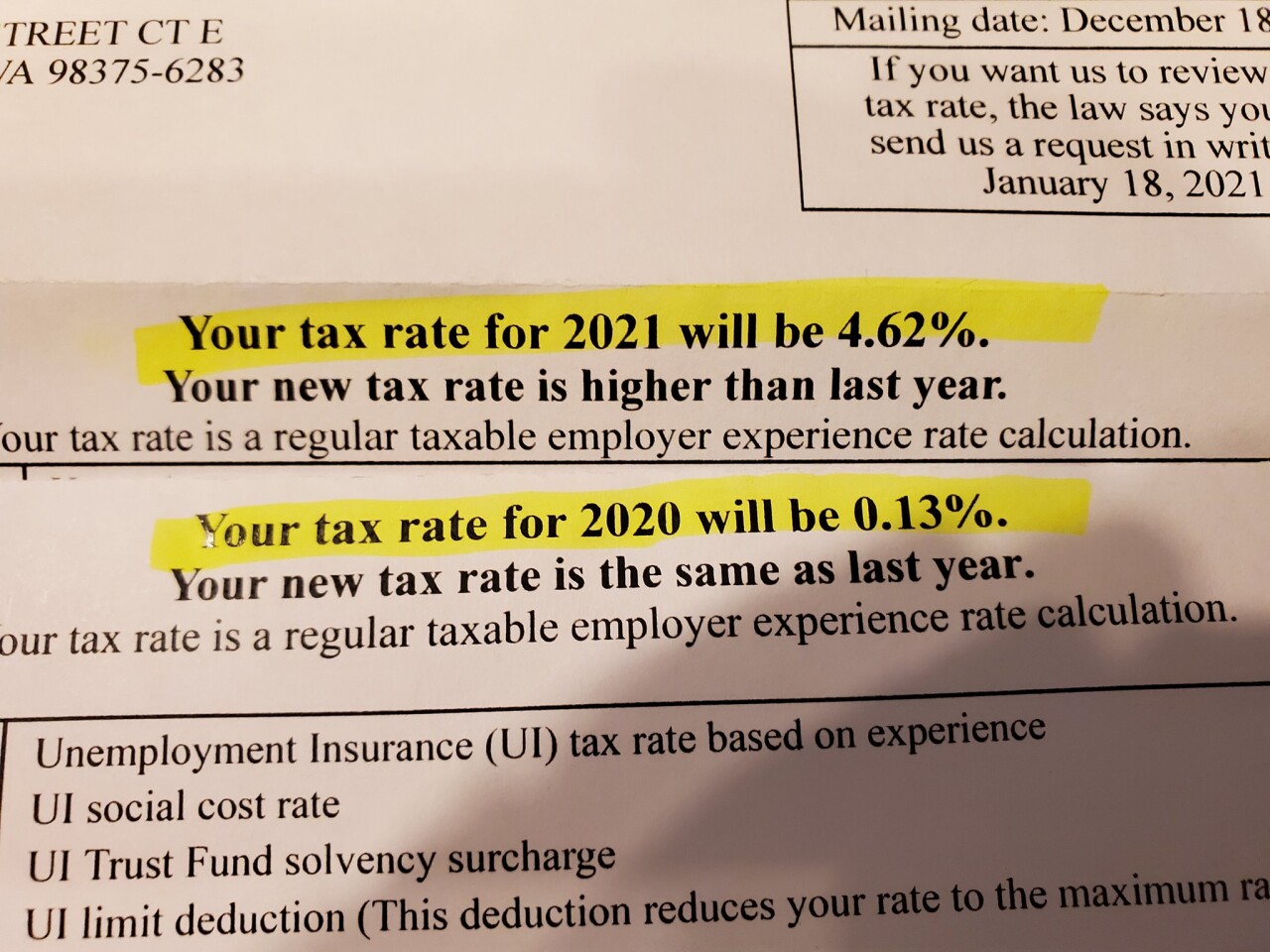

The resulting tax rate increases are enormous, as most businesses are finding. Many businesses are seeing increases of triple or quadruple their 2020 UI tax rates. Some are seeing their new rates skyrocket more than 3000% past 2020 levels. One business found that their unemployment tax rate increased by over 4600%, apparently due to their single employee being furloughed earlier this year.

Due to the enormous impact of Governor Inslee’s coronavirus business restrictions, and the accompanying instant and unprecedented unemployment for millions of employees in the state, the state unemployment fund is now all but tapped out. In addition, there was the payment of at least 650 million dollars in fraudulent claims by foreign criminal gangs, due to the incompetent administration by Inslee appointed ESD Commissioner Suzi LeVine. To date, only about 350 million dollars of the total handed over in fraudulent claims has been recovered by Federal investigators.

For some businesses, just the unemployment insurance tax that they are responsible for paying per employee is now over 6% of each employee’s wages, where the previous rates may have been lower than 0.5%. As many businesses are finding, the following years tax rates greatly increase if a business has to lay off employees, and they then claim unemployment benefits. But even businesses that did not lay off anyone, must still pay a “social cost” into the UI system for 2021 that greatly increases their previous rate.

Unfortunately, huge tax increases such as this will naturally result in less employment in 2021. Businesses will end up hiring fewer employees, and some may forego employees altogether and stay small and fully owner-operated. A number of businesses are already looking for better business climates outside of this state, and are planning to leave, looking toward lower tax areas such as Idaho.

There is also another hit for businesses looming on the horizon. If unemployment continues at these higher 2020 rates, whether through such causes as draconian and ongoing coronavirus restrictions imposed by Inslee or economic depression stemming from such actions, the state UI fund will be exhausted before mid-2021, and then must borrow from the Federal government in order to pay claims. If that happens, then businesses can expect another enormous tax increase to repay those Federal loans and penalties.

These increased tax rates don’t end anytime soon, as the damage to the state UI fund is extensive and will require additional special tax assessments in 2022 and 2023 to ensure its solvency. Further, employer contributions to the fund are projected to remain at significantly elevated levels through 2025, according to ESD's Labor Market Information division.

At ESD, despite permitting the largest fraud in state history, a scandal of enormous proportions, no one responsible has been fired. In addition to the lack of accountability, Levine and bureaucrats at ESD are hindering audits into the department by the state auditor’s office. ESD is also being audited by the U.S. Department of Labor and the Justice Department.